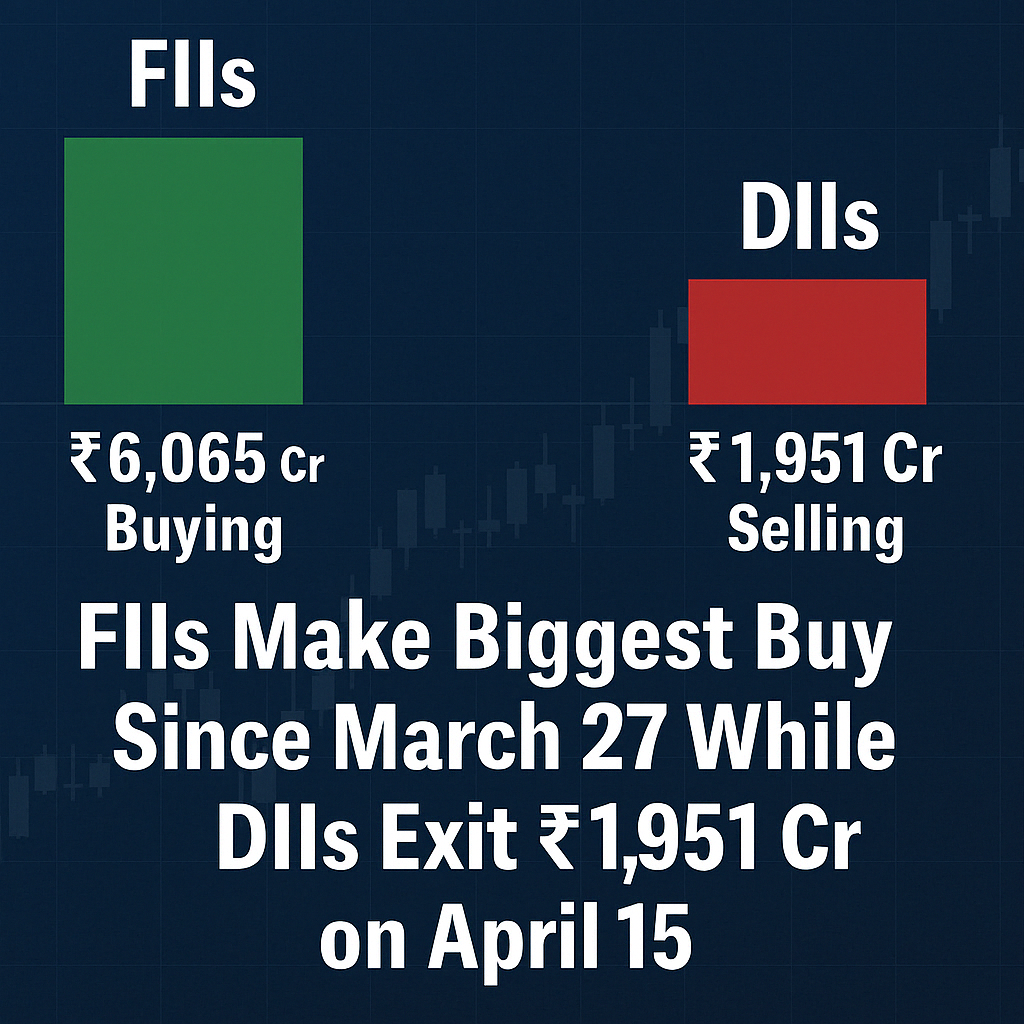

April 15, 2025, saw a sharp turn in institutional flows into Indian equities. After a mixed trend over the past few sessions, Foreign Institutional Investors (FIIs) came back with strong buying — recording their highest net inflow since March 27, while Domestic Institutional Investors (DIIs) were on the selling side, booking profits.

The divergence in FII and DII behavior is being closely watched by market participants, as it hints at a shift in short-term sentiment and positioning.

📊 Institutional Activity Snapshot – April 15, 2025

Here’s a quick look at the numbers:

| Category | Buy Value (₹ Cr) | Sell Value (₹ Cr) | Net Value (₹ Cr) |

|---|---|---|---|

| FIIs | ₹25,103 | ₹19,037 | ✅ ₹6,065 |

| DIIs | ₹11,259 | ₹13,211 | ❌ ₹1,951 |

While FIIs infused over ₹6,000 crore into Indian equities, DIIs took a cautious stance, offloading shares worth nearly ₹2,000 crore. This marks a reversal of recent patterns, where DIIs were steady buyers and FIIs showed inconsistent behaviour.

🔍 Why Are FIIs Buying Again?

FIIs had turned sellers earlier due to global uncertainties — including rising US bond yields, geopolitical risks, and a mixed outlook on inflation. However, recent developments have turned the tide:

- Global Markets Stabilizing: US and European markets have steadied after recent volatility, reducing global risk-off sentiment.

- Better Than Expected Earnings Projections: Early estimates from Indian corporates show promise in sectors like banking, auto, and capital goods.

- Rupee Stability: The INR has remained relatively stable against the US dollar, making Indian assets more attractive.

- China Slowdown Advantage: Global investors are looking at India as a relatively resilient and stable alternative to China.

These factors likely contributed to the renewed confidence among foreign funds.

🏦 Why Did DIIs Sell?

Unlike FIIs, DIIs are often value-focused and tend to book profits when markets show strong rallies. On April 15, indices traded higher, possibly prompting DIIs to:

- Book gains after a steady run-up in prices

- Rebalance portfolios for Q1 FY26

- Await better entry levels post earning announcements

This profit-booking is a healthy sign and does not necessarily signal bearishness from domestic institutions.

📈 Market Reaction

The strong FII inflow helped maintain positive sentiment across Indian equities. Here’s how the broader market reacted:

- Nifty 50 closed above key resistance levels, gaining strength

- Sensex rose on strong volumes in financial and IT stocks

- Bank Nifty and midcaps saw active participation

- Volatility index (India VIX) stayed near comfortable levels, indicating bullish bias

This shows that foreign fund inflows still hold sway in shaping market direction, especially when backed by domestic participation.

🧠 Sectoral Trends Observed

On the same day, sectors that gained significant FII attention included:

- Banking & Financials: Large private banks and NBFCs saw strong buying interest

- IT: Beaten-down tech stocks gained on hopes of improved global demand

- Capital Goods & Infra: A proxy for India’s growth story, these sectors remained in favour

- Autos: Demand visibility and rural recovery made this a preferred theme

Sectors where DIIs trimmed positions were mostly FMCG, pharma, and PSU banks — possibly after a strong rally in recent weeks.

📅 Historical Context: Why This Is Important

This ₹6,065 crore net FII inflow is the biggest single-day buy since March 27, a day when Indian indices also saw massive volume-driven rallies. Whenever such sharp inflows happen, they usually reflect:

- A positioning shift in global portfolios

- Confidence in India’s near-term outlook

- A potential start of a short-term bullish leg

However, in the past, such rallies have also seen quick profit-booking, especially if macro data or earnings disappoint. Hence, investors must stay informed, but not emotional.

📌 Conclusion: FII Firepower is Back — But Stay Smart

April 15 was a power-packed day for Indian equities — with foreign investors bringing back conviction and DIIs tactically adjusting. The FII-DII split shows how institutions view the current market differently, and that diversity is healthy.

What matters most now is how earnings pan out, how global cues evolve, and whether this FII momentum continues. If it does, Indian markets may retest recent highs — and if DIIs re-enter on dips, we could be in for a strong summer rally.

Stay tuned to Paisonomics.com for daily FII-DII updates, stock market trends, and analysis simplified for real investors.